What separates quality businesses from the rest

Research from McKinsey analyzing 615 companies over 15 years revealed something counterintuitive: the businesses that consistently delivered superior returns shared behavioral patterns that had nothing to do with their industry, size, or market conditions.

Even more striking? A Harvard Business School study of over 1,000 acquisitions found that 67% of failures traced back to factors that never appeared in the financial models. The companies that failed had strong financials right up until they didn’t.

This points to a fundamental gap in how we evaluate business quality. We’re looking at the wrong things entirely.

Why traditional analysis systematically misses quality

Walk into any investment committee, and you’ll hear the same metrics: revenue growth, EBITDA margins, market share, competitive positioning. All important, but research shows they’re lagging indicators of business quality, not predictive ones.

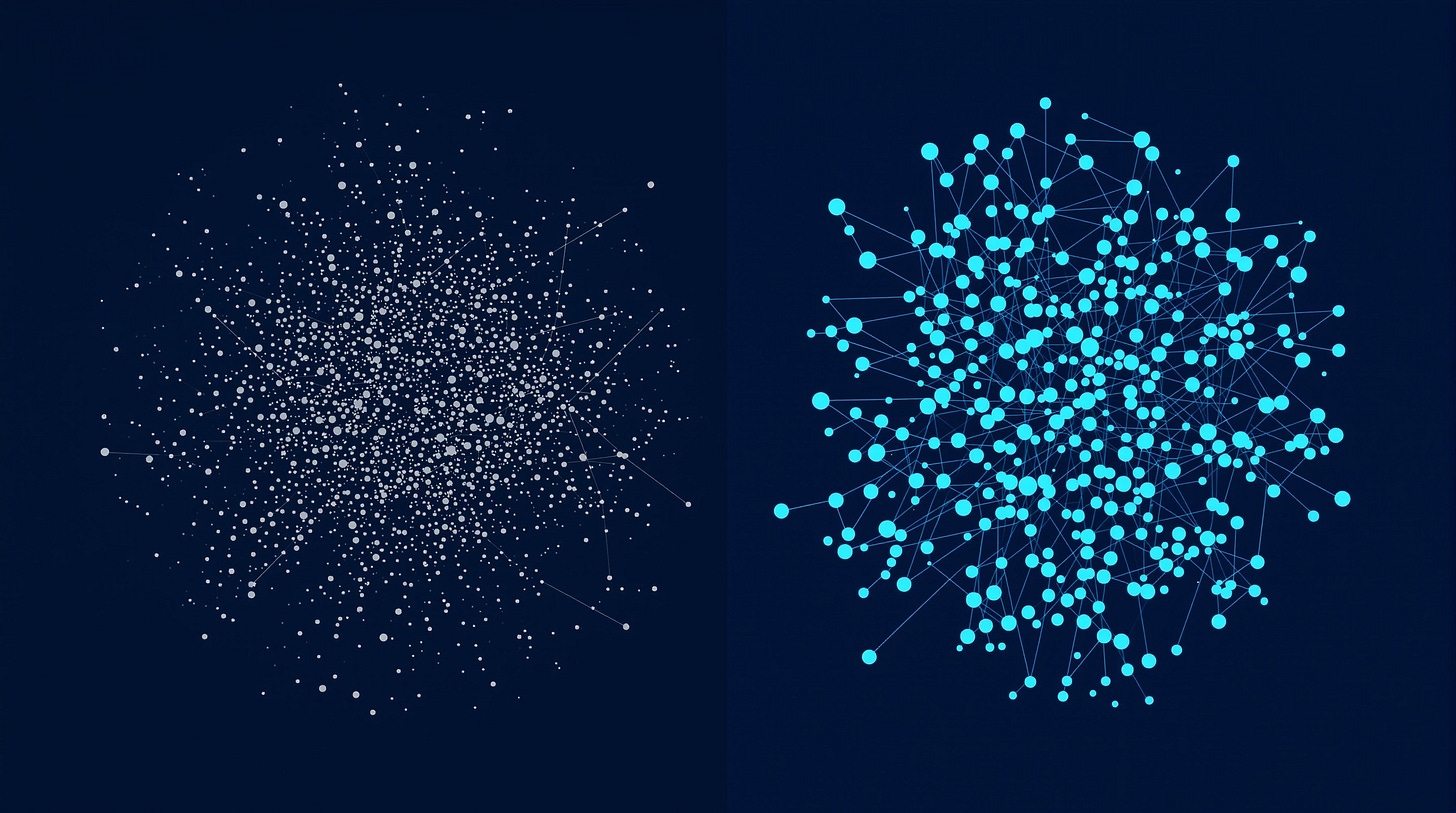

The problem is what behavioral economists call “measurement bias.” We obsess over what’s easy to quantify while ignoring the psychological and organizational dynamics that actually drive long-term performance.

Financial metrics tell you what happened, but they don’t tell you why it happened or whether it’s sustainable. It’s like trying to predict athletic performance by only looking at yesterday’s scores while ignoring training methods, recovery protocols, and mental preparation.

What research reveals about lasting business quality

Jim Collins spent decades studying this exact question. His research team analyzed thousands of companies to understand what separates good from great. But here’s what most people missed from his work: the companies that made the leap weren’t necessarily the smartest or best-funded. They had developed what organizational psychologists call “systematic excellence habits.”

Stanford’s organizational behavior research identifies four behavioral patterns that predict long-term business performance better than financial metrics:

Decision velocity under uncertainty - Quality businesses make high-quality decisions faster than competitors. Research shows this correlates with long-term outperformance more than any other single factor.

Learning orientation after failures - How an organization responds to setbacks predicts future resilience. Quality businesses systematically turn failures into competitive advantages.

Information flow transparency - Companies with faster, more accurate internal communication consistently outperform those with hierarchical information bottlenecks.

Stakeholder psychology management - Quality businesses understand the behavioral incentives of customers, employees, and partners in ways that create sustainable loyalty.

These patterns compound over time. A business that makes slightly better decisions, learns slightly faster from mistakes, communicates slightly more effectively, and understands stakeholder psychology slightly better will dramatically outperform over decades.

The 60-second quality assessment framework

Based on organizational psychology research from Wharton and Stanford, here’s how to quickly assess business quality in any situation:

The Quality Business Decoder Based on research analyzing 500+ high-performing organizations

Step 1: Ask about their biggest recent challenge Listen for: How quickly they identified the problem, who was involved in solving it, what they learned

Step 2: Request a decision-making example Observe: How many people needed to approve it, how long it took, what information they gathered

Step 3: Explore their biggest failure from last year Watch for: Whether they take responsibility, what systems they changed, how they prevent recurrence

Step 4: Understand their customer feedback loop Assess: How customer insights reach decision-makers, how quickly they act on feedback

What research shows these responses reveal:

Fast, thoughtful responses = High-quality decision-making systems and learning culture

Defensive or vague answers = Organizational dysfunction likely impacting performance

Systematic learning from failures = Resilience and continuous improvement capabilities

Direct customer-to-leadership feedback = Market responsiveness and adaptation ability

The businesses that excel in this assessment consistently outperform those that don’t, regardless of industry or size.

Advanced quality recognition

Quality businesses share subtle behavioral markers that traditional analysis overlooks:

They hire for potential, not just experience - Research shows quality businesses invest more in developing people internally rather than constantly hiring external “talent.”

They optimize for decision quality, not decision speed - While they decide faster than competitors, they invest heavily in decision-making frameworks and information systems.

They view competitors as market validators, not threats - Quality businesses focus on creating customer value rather than beating competitors, which paradoxically makes them more competitive.

They measure leading indicators, not just results - They track behavioral metrics like employee engagement, customer effort scores, and decision cycle times alongside financial performance.

Why this creates lasting competitive advantage

Here’s the fascinating part: these quality patterns are incredibly difficult for competitors to replicate. Anyone can copy a product, pricing strategy, or business model. But you can’t quickly copy organizational decision-making quality, learning culture, or stakeholder psychology understanding.

Research from competitive strategy shows that behavioral advantages compound exponentially. A business with slightly better decision-making, learning, and stakeholder management will pull further ahead over time, not just maintain its lead.

Quality businesses don’t just perform better in good times, they’re the ones that emerge stronger from downturns, adapt faster to market changes, and build more sustainable competitive positions.

Your next quality assessment

The next time you’re evaluating any business try this approach: spend less time on the financial presentation and more time understanding how they actually operate.

Ask about their recent challenges, decision-making processes, and learning from failures. Pay attention to how information flows and how they think about stakeholders. The businesses that excel in these areas consistently deliver superior long-term performance.

Quality isn’t just about having good numbers today. It’s about having the organizational capabilities to create good numbers tomorrow, next year, and next decade.

Apply this framework and notice how it reveals aspects of business performance that traditional analysis systematically misses.