What Klarna teaches us about crisis discipline.

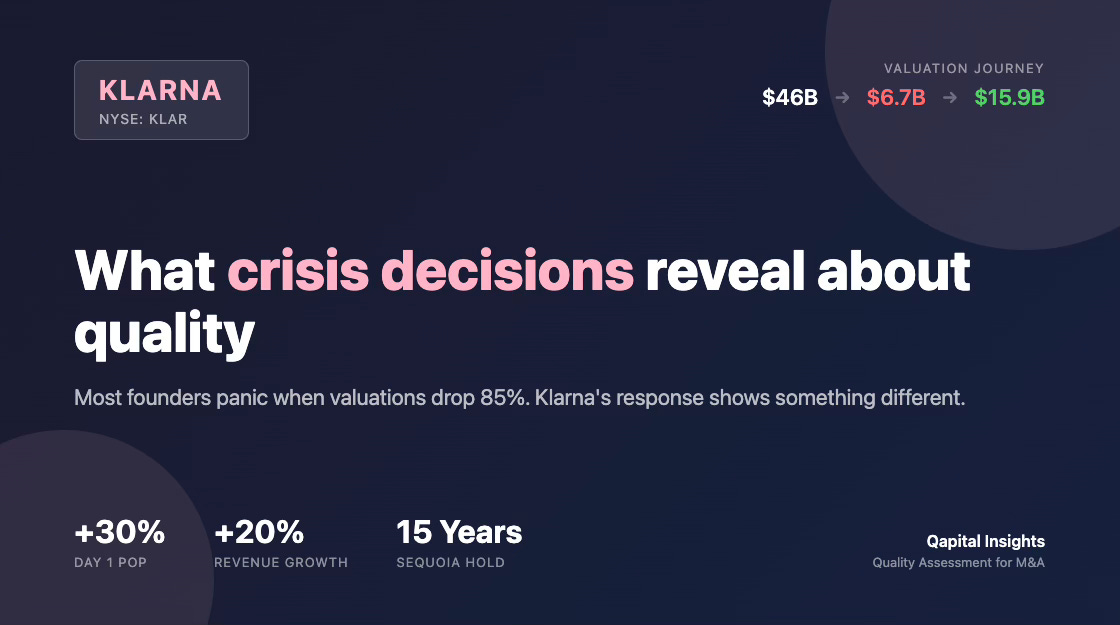

Klarna opened at $52 on Wednesday, September 10, 2025, jumping 30% from its $40 IPO price. The Swedish fintech priced above range and now trades at roughly $16 billion. Not bad for a company that was valued at $6.7 billion just three years ago, down from a 2021 peak of $46 billion.

Most commentary focuses on the valuation rollercoaster or whether buy now, pay later is a real business. That misses the more interesting question: what do Klarna’s decisions during the collapse tell us about organizational quality?

When evaluating acquisition targets, I care less about what management does when everything works. I want to know what they do when the world says they’re finished.

The crisis nobody remembers

In 2022, Klarna looked dead. Growth stocks crashed. BNPL competitors imploded. SoftBank’s $46 billion bet looked catastrophic. The narrative shifted overnight from “fintech unicorn” to “unsustainable business model.”

Here’s what Siemiatkowski did: nothing dramatic. No desperate pivot. No panic fundraising at terrible terms. No mass layoffs to juice short term profitability metrics.

Instead, Klarna tightened credit underwriting, focused on unit economics, and kept building. Revenue growth continued at 20%+ annually while credit losses stabilized at 0.57% of transaction volume. Not exciting, but disciplined.

The behavioral pattern that matters: when your valuation drops 85% and everyone questions your business model, most founders either capitulate or overcorrect. Siemiatkowski did neither. That’s unusual decision-making under pressure.

What the IPO structure reveals

This IPO raised $222 million in new capital. Existing shareholders sold $1.2 billion worth of stock. That ratio typically signals trouble, early investors heading for exits while they can.

But context matters. Sequoia invested $500 million over 15 years, sold only 2 million of 79 million shares, and generated $2.65 billion in paper returns. SoftBank, who bought at the peak, is finally getting some liquidity. This isn’t panic selling. It’s rational portfolio management after a 15 year hold.

The fact that Klarna didn’t need to raise significant new capital at the IPO actually demonstrates confidence. They’re operationally self-sufficient, growing revenue, and chose to reward patient capital rather than dilute further.

Compare this to companies that raise maximum capital at IPO because they need runway. Klarna is choosing to go public on their own terms, not because they’re desperate for cash.

The quality signals that matter for acquirers

When I assess potential acquisitions, three elements from my framework jump out in Klarna’s story:

Quality of business economics. Revenue growing 20%+ while improving credit metrics and reducing losses. The business model isn’t broken, it was mispriced. Management focused on fixing unit economics rather than chasing vanity growth metrics. That’s harder to do than it sounds when your valuation collapses.

Team and organization. Decision-making quality under extreme pressure reveals more than performance during boom times. Siemiatkowski maintained strategic focus through an 85% valuation decline. Most founders panic, pivot, or burn out. The fact that Klarna’s product roadmap and market expansion continued steadily through 2022-2024 shows organizational depth beyond the founder.

Long term orientation. The company absorbed significant share-based compensation costs rather than cutting back on talent retention. That’s choosing sustainable competitive advantage over reported profitability. It’s also why they still have 700,000 US card customers and 5 million on the waiting list, they kept building through the crisis.

The lesson for private market acquirers

Public market investors will debate whether Klarna deserves an $16 billion valuation. That’s a different question than whether Klarna demonstrates quality as an organization.

For those of us evaluating private companies for acquisition, the pattern recognition exercise is clear: watch what founders do in the valley, not just on the peak.

A founder who maintains discipline through an 85% valuation collapse, continues investing in the business, focuses on unit economics rather than headlines, and emerges with accelerating revenue growth has demonstrated something valuable. That decision-making pattern is worth paying attention to.

You can’t fake this kind of resilience. You either have the organizational quality to weather existential doubt or you don’t. Klarna did. That’s the signal that matters, regardless of what happens to the stock price from here.

The next time you’re evaluating a target that’s been through a rough patch, spend less time on the financial recovery story. Focus on the decision patterns during the crisis. That’s where you find out if the business has real quality or just got lucky when conditions were favorable.