The real reason behind Warren Buffet selling Apple shares

Warren Buffett's latest move to sell Apple shares has drawn investors' attention worldwide. This marks a major change in Berkshire Hathaway's portfolio management, as Apple has been the conglomerate's biggest holding for years. His decision makes us think over market values and long-term investment views in today's economic climate.

A closer look at Buffett's investment strategy shows there's more to this than just booking profits. Berkshire's changing stance on Apple points to wider market forces, economic indicators, and the need to rebalance portfolios. The size of this sale, the mechanisms behind it, and what it all means for Berkshire's financial future deserve a deeper look.

The scale of Buffett's Apple divestment

Berkshire Hathaway's recent divestment of Apple shares stands out as unprecedented. The conglomerate has reduced its Apple holdings by 605 million shares since the end of 2023. This represents a 70% reduction in its position. Berkshire's Apple investment value dropped from $174.3 billion at the end of 2023 to about $70 billion in the latest reporting period.

The company planned and executed this reduction through several steps:

Q4 2023: The original reduction phase

Q1 2024: 13% stake reduction (-116 million shares)

Q2 2024: 49% further reduction (-389 million shares)

Q3 2024: Additional 25% reduction (-100 million shares)

Apple remains Berkshire's largest single investment position despite this substantial reduction. Warren Buffett started this position in Q1 2016. Berkshire has made fourteen purchases at an average price of $39.62 per share over the last several years. The company also executed eight strategic sales at an average price of $169.33, which shows its investment expertise in managing this position.

Berkshire's current stake has approximately 300 million shares, which represents 2.63% of Apple's outstanding stock. This substantially reduced position still makes up over 30% of Berkshire's equity portfolio. This highlights its continued importance in the conglomerate's investment strategy.

Buffett's economic outlook

Market indicators have led the legendary investor to take a cautious approach, which shows clearly in Berkshire Hathaway's recent decisions. The company now holds a record $325.20 billion in cash, up from $276.90 billion in June. These numbers show the company's serious doubts about current market values.

Buffett's economic outlook matches widespread worries about market basics. During Berkshire's annual shareholder meeting in Omaha, he pointed out several warning signs in the economy:

Market values look too high, similar to 1999

The U.S. government will likely raise taxes to fix budget gaps

The Congressional Budget Office says federal deficits could reach 8.5% of GDP by 2054

The U.S. government's debt levels might not be sustainable

The investment legend's viewpoint on market behavior tells us much. Modern markets act more like casinos than they did decades ago. Technology helps information spread faster and can magnify group-think behavior. This reality has pushed Berkshire to prefer Treasury bills, as the company moves to protect its capital during uncertain economic times.

Buffett believes higher taxes will come instead of spending cuts to fix growing deficits. His careful approach suggests he prepares for possible market corrections and economic challenges that lie ahead.

Berkshire's evolving investment strategy

Berkshire Hathaway's investment strategy development shows how it moved from Benjamin Graham's "cigar butt" investing approach to a sophisticated philosophy. The company now focuses on acquiring exceptional businesses at reasonable valuations. Charlie Munger's view substantially influenced this transformation and created several key principles:

Emphasis on businesses with durable competitive advantages

Focus on strong management teams and ethical leadership

Preference for simple, understandable business models

Long-term investment horizon with minimal portfolio turnover

Current market conditions have refined this strategy further, and Berkshire now maintains unprecedented liquidity levels. The company has paused share buybacks for the first time since 2018, which indicates a conservative stance toward market valuations. This approach connects with Buffett's intrinsic value methodology and suggests that current market prices exceed conservative valuations.

Berkshire now takes a more nuanced view of technology investments. This marks a shift from its previous skepticism while maintaining strict valuation discipline. The company's large cash position generates $15 billion in annual interest income. This demonstrates how Berkshire adapts to current market conditions while staying ready to seize future opportunities.

Impact on Berkshire's financial position

Berkshire Hathaway has grown stronger financially after adjusting its portfolio strategy in 2024. The company now holds a record $325.20 billion in cash reserves. This marks their eighth straight quarter of net stock sales. Their investment income patterns have also changed dramatically.

Key financial numbers tell the story:

Investment income jumped 48% to $3.66 billion

Operating earnings dropped 6% year-over-year

Insurance float grew to $174 billion

Five major holdings total $188.9 billion

Berkshire's insurance operations remain strong despite lower operating earnings. Geico's profitability has improved and insurance investments continue to deliver solid returns. The company keeps most of its cash in short-term Treasury bills, which generate substantial interest income in today's high-yield market.

The company's stock portfolio stays focused on five main companies: Apple, American Express, Bank of America, Coca-Cola, and Chevron make up 70% of holdings. This concentrated approach and large cash reserves give Berkshire both stability and flexibility to invest when market opportunities arise.

Warren Buffett's careful selling of Apple shares shows a transformation in how Berkshire Hathaway invests money. This change reflects his worries about market values and economic stability. Berkshire sold 605 million shares but kept Apple as its biggest investment. This shows smart money management rather than losing faith in the company. Buffett's company now holds record cash reserves of $325.20 billion. These moves line up with his careful view of the economy and his concerns about market basics.

So what is the current view on Apple? Let’s have a look at the key company quality highlights.

(+) Increasing gross margin

AAPL gross margin has increased over last 5 years (from 37.8% to 44.1%)

(+) ROIC vs Industry

AAPL is generating higher ROIC (56.1%) than the Technology industry average (3.3%)

(-) Does Apple have a healthy balance sheet?

AAPL has less cash&equivalents ($61.8B) than its total debt ($101.3B)

(+) P/E vs Peers

AAPL is good value based on its earnings relative to its share price (31.5x), compared to its Peer set median (33.4x)

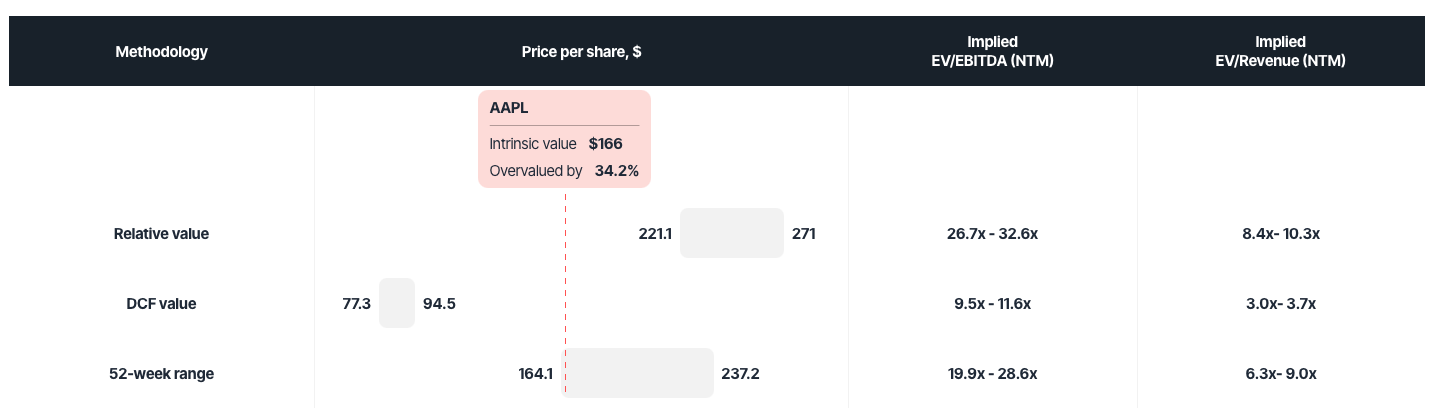

So is Apple overvalued or not? Currently Apple trades at 226 USD. However, intrinsic value of Apple is 166 USD.

Image source: Value Sense

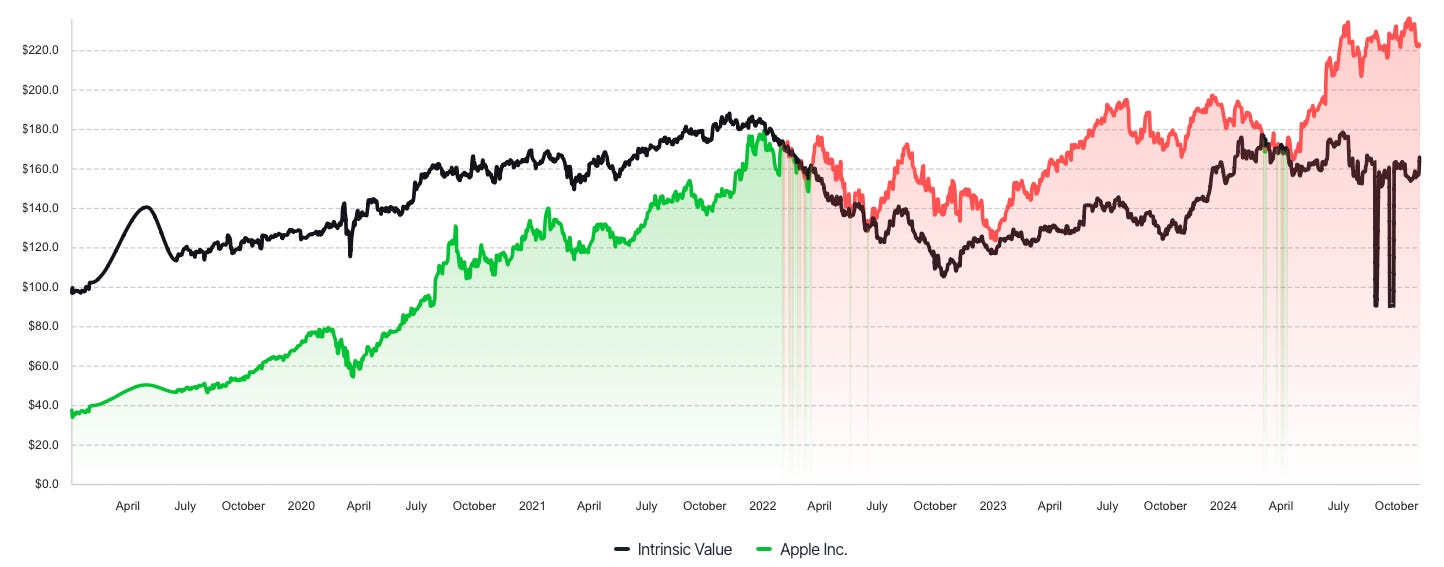

Yes, there is a substantial difference between the DCF method and relative value. Other sources show a DCF outcome of 127 USD. Fair value also shows numbers between 84 and 160 USD. Over the last 4 years Apple moved from undervalued to overvalued following the bull run especially for tech stocks.

Image source: Value Sense

All in all, Apple seems significantly overvalued at the moment so Warren Buffet might have made a good decision to start selling shares. Even though markets are still on the uprise, situation could change quickly. The oracle of Omaha has shown multiple times that he made the right decision at the right time. Question is now…are you going to follow his strategy of has Apple a solid place in your portfolio?