Oracle of Omaha: Warren Buffet's holdings

Every week we highlight a well known investor, his investment philosophy and current holdings. Warren Buffett, often called the "Oracle of Omaha," has become synonymous with successful investing through his leadership of Berkshire Hathaway and his remarkable track record spanning over six decades. His approach to investing has influenced generations of investors and created substantial wealth for his shareholders.

Core investment principles

Value investing

At the heart of Buffett's philosophy lies value investing, a concept he learned from his mentor Benjamin Graham. This approach focuses on identifying undervalued companies with strong fundamentals and buying them at a price below their intrinsic value. Buffett famously quips that "price is what you pay, value is what you get."

Long-term perspective

Unlike many modern investors focused on quarterly results, Buffett advocates for a long-term investment horizon. His famous quote, "Our favorite holding period is forever," emphasizes his belief in buying great businesses and holding them through market fluctuations.

Circle of competence

Buffett strongly believes in investing only in businesses you understand. He calls this staying within your "circle of competence." This principle has led him to avoid many technology investments during the dot-com boom, a decision that proved wise when the bubble burst.

Investment criteria

Strong economic moat

Buffett seeks companies with sustainable competitive advantages or "economic moats." These might include:

- Strong brand recognition (like Coca-Cola)

- High switching costs (like banking services)

- Network effects (like credit card networks)

- Regulatory advantages (like utilities)

Quality management

Management integrity and competence are crucial factors in Buffett's investment decisions. He looks for honest, capable leaders who treat shareholders' capital with respect and make rational capital allocation decisions.

Financial strength

Buffett prioritizes companies with:

- Consistent earnings growth

- High return on equity

- Low debt levels

- Strong free cash flow

- Predictable business models

Risk management

Margin of Safety

Buffett emphasizes the importance of having a margin of safety – buying at a price significantly below the calculated intrinsic value to provide protection against errors in analysis or unforeseen circumstances.

Concentrated portfolio

Unlike modern portfolio theory advocates, Buffett believes in concentration over diversification. He famously stated, "Diversification is protection against ignorance. It makes little sense if you know what you are doing."

One of his famous quotes: “Rule No. 1 is never to lose money. Rule No. 2 is never forget Rule No. 1.”

Notable investment principles

Be fearful when others are greedy

One of Buffett's most famous principles is to be "fearful when others are greedy, and greedy when others are fearful." This contrarian approach has helped him capitalize on market panics and avoid bubbles.

Compound interest magic

Buffett recognizes the power of compound interest, calling it the "eighth wonder of the world." His success comes not just from good investment choices but from allowing investments to compound over decades.

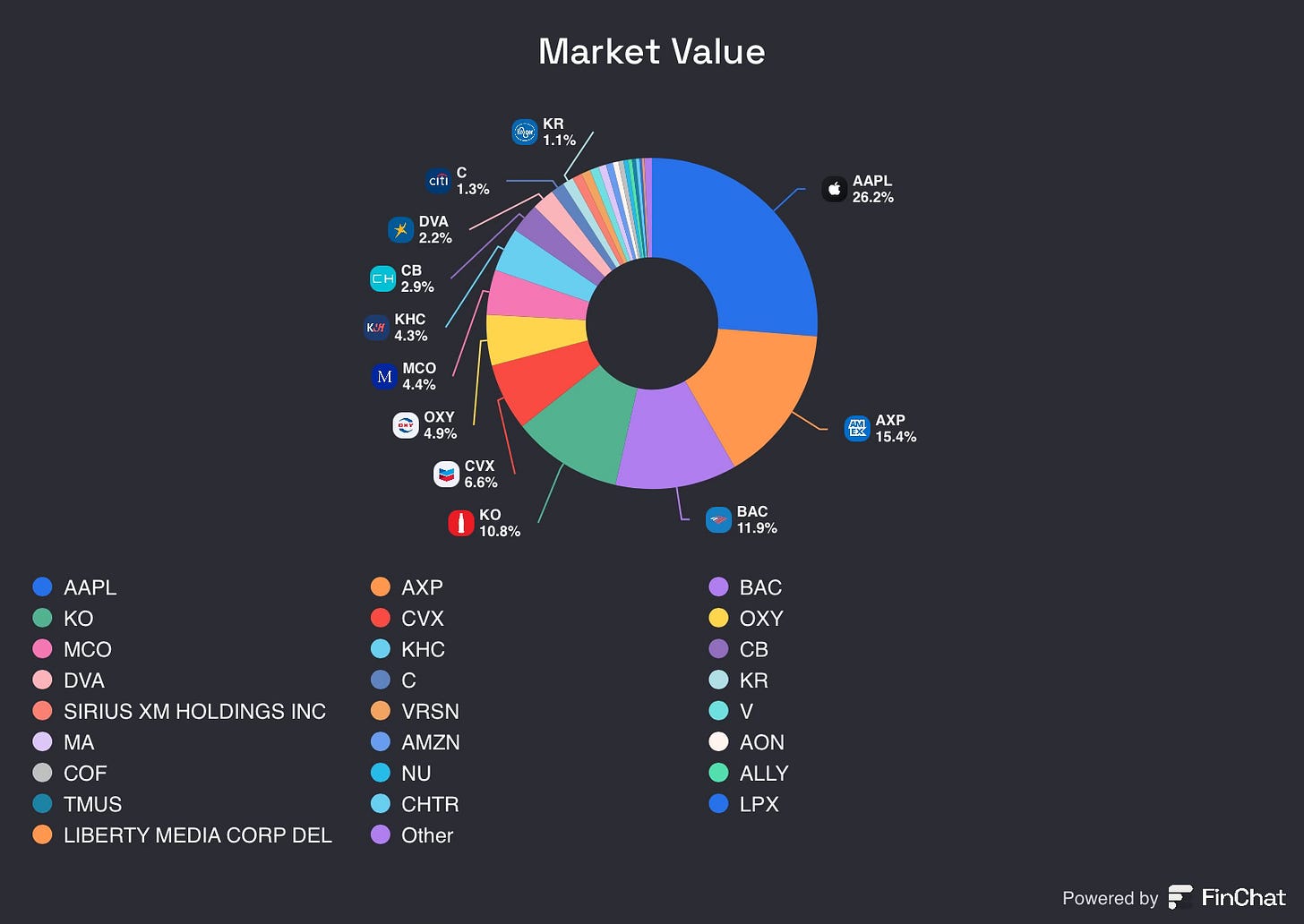

Current holdings

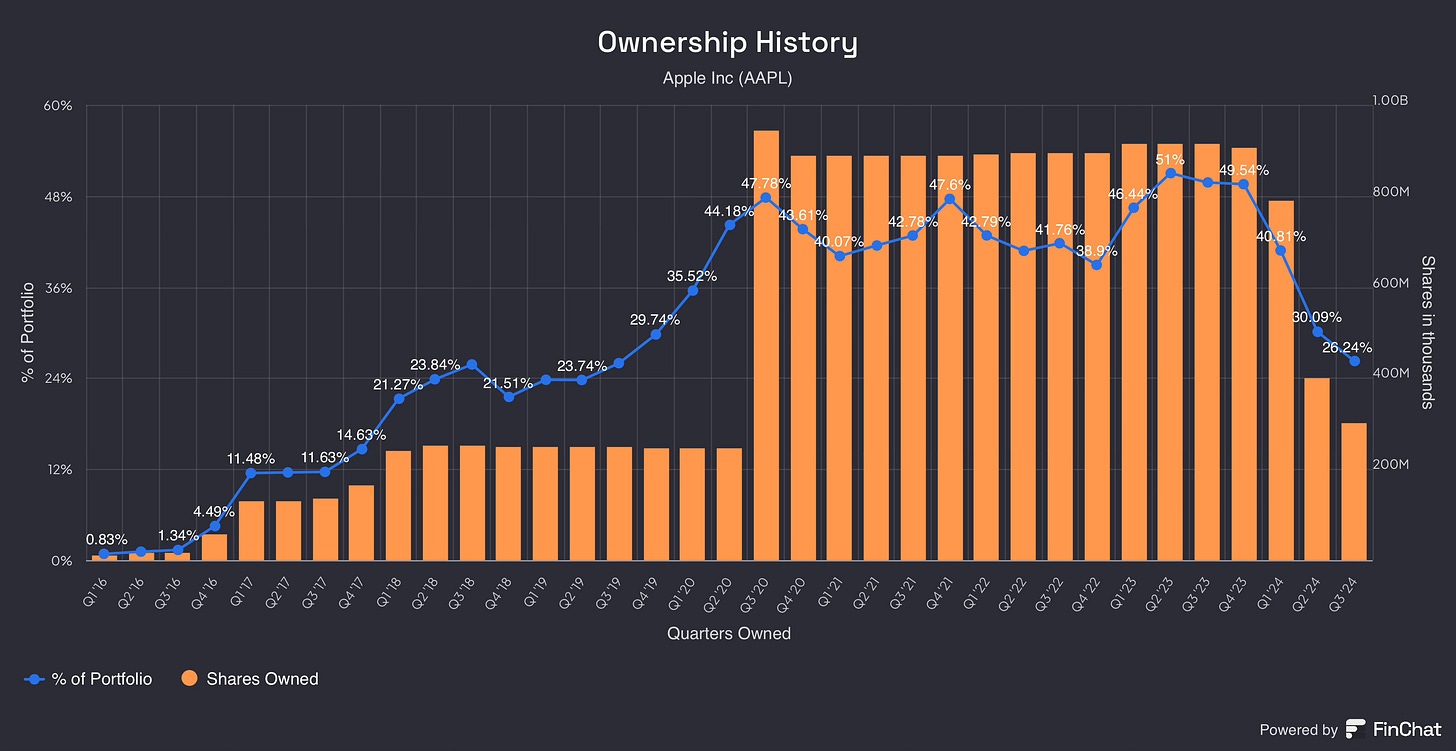

His largest position is Apple, but he he has been selling shares in the recent months. Read more on his strategy here: The real reason behind Warren Buffet selling shares

Warren Buffet currently holds assets with a market value of 266B and has an average holding period of 18 years. Buffett's approach requires patience and discipline. He often waits years for the right opportunity to invest at the right price, comparing it to waiting for the perfect pitch in baseball.

Warren Buffett's investment philosophy combines simple principles with rigorous analysis and unwavering discipline. His approach emphasizes understanding businesses thoroughly, investing for the long term, and maintaining emotional stability through market cycles. While his methods may seem straightforward, their successful execution requires dedication, patience, and continuous learning – qualities that have made Buffett one of the most successful investors in history.

Subscribe for more insights on the best investors in the world.