From red to black: How 5 tech giants finally cracked the profit code

Remember when tech companies could burn through cash like there was no tomorrow? Those days are fading fast. Some of the biggest names in tech have pulled off an impressive magic trick – turning years of losses into serious profits. And they've done it through what might be the most powerful force in business: operating leverage.

Think of operating leverage like a tech company's version of a factory. Once you've built it, each additional widget (or in this case, user) costs almost nothing to serve. It's why software companies can go from bleeding money to printing it seemingly overnight.

Let's dive into five companies that have mastered this game:

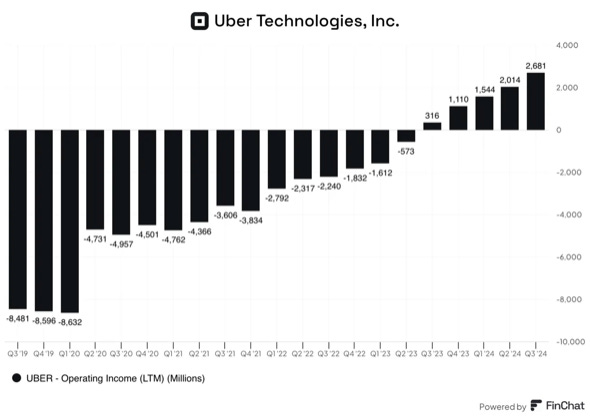

1. Uber: The $90 billion bet that finally paid off

Remember when everyone thought Uber was just burning money with no end in sight? Those critics weren't entirely wrong. Uber spent billions building its marketplace, and for years the losses were staggering. But here's the thing about network effects – once they kick in, they kick in hard.

The numbers tell the story

2017: Losing 49 cents on every dollar (ouch!)

2024: Making 6 cents on every dollar (not bad!)

What changed? Uber doesn't have to bribe drivers and riders to use its platform anymore. The network is self-sustaining. When you're the go-to app for getting around town, you don't need to spend a fortune on marketing. More rides mean more profit, and the cost of adding each new ride is tiny.

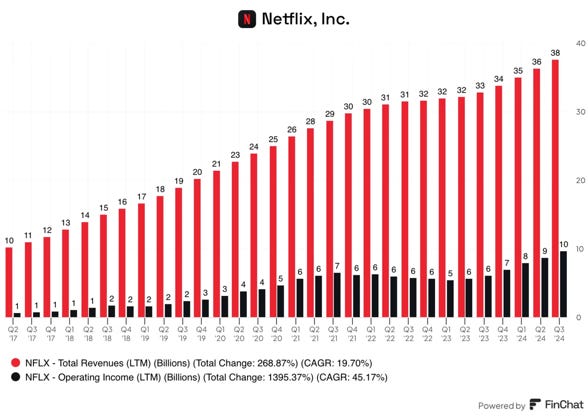

2. Netflix: How to turn binge-watching into a money machine

Netflix might be the greatest example of playing the long game in tech history. While other streaming services are still figuring out how to make money, Netflix has turned into a profit powerhouse.

The transformation

2015: 5% margins (barely breaking even)

2024: 26% margins (now we're talking!)

Here's what's fascinating about Netflix: They spent years taking heat for their massive content budgets. But now that they have hundreds of millions of subscribers, each new show or movie gets amortized across a massive audience. Better yet, their back catalog keeps working for them year after year. It's like they built a content factory that gets more efficient over time.

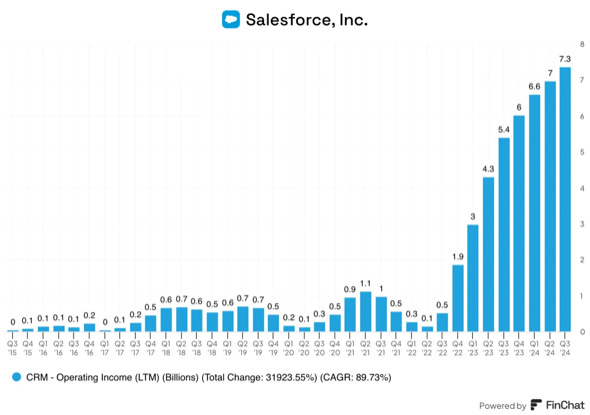

3. Salesforce: The 20-year overnight success story

Salesforce is proof that patience pays off in software. For two decades, they poured money into growth, and critics wondered if they'd ever focus on profits. Turns out, they were building a profit machine all along – they just needed a little push to turn it on.

The journey

2015: 1% margins (breaking even, barely)

2024: 20% margins (hello, profit!)

What changed? Some activist investors showed up and essentially said, "Hey, maybe we don't need to hire a new person for every new dollar of revenue?" Turns out, when you have thousands of happy customers who renew every year, you can ease off the growth gas pedal and let the profits flow.

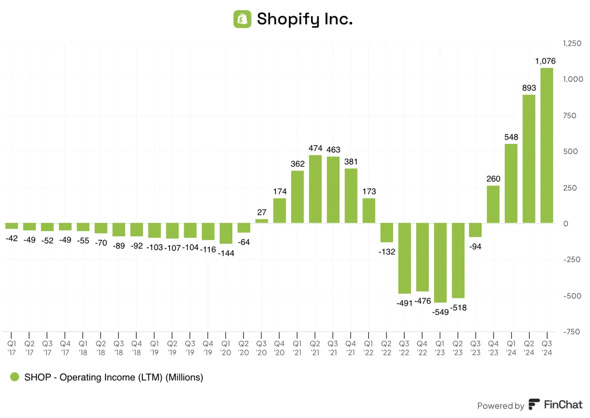

4. Shopify: E-commerce's silent profit machine

Shopify spent years building the perfect mousetrap for e-commerce. While Amazon sells stuff, Shopify helps everyone else sell stuff. And now that they've built the platform, each new merchant is nearly pure profit.

The story in numbers

2019: -9% margins (investing in growth)

2024: 13% margins (reaping the rewards)

The beauty of Shopify's model? Once they build a feature, every merchant can use it. They're essentially running an e-commerce operating system, and like all good software, it gets more valuable – and more profitable – with scale.

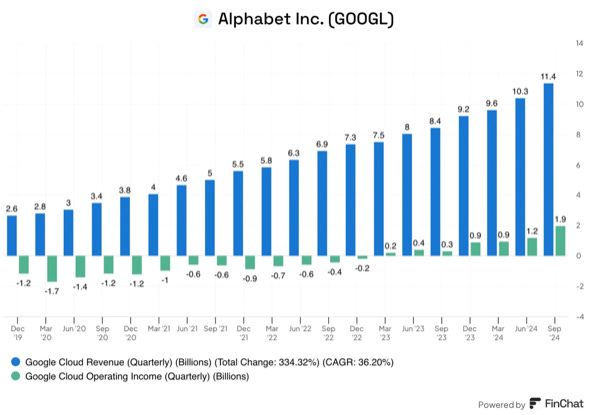

5. Google Cloud: The sleeping giant wakes up

Everyone knows about AWS's incredible profits, but Google Cloud's transformation might be even more impressive. They went from being the "other cloud" to a serious profit center for Alphabet.

The turnaround

2018: -74% margins (big yikes!)

2024: 17% margins (big yes!)

What happened? Scale, scale, and more scale. Cloud computing is the ultimate operating leverage business. Once you build the data centers and the infrastructure, each new customer makes everything more efficient. Google kept investing until they hit that tipping point, and now they're reaping the rewards.

The big picture: Why this matters

There's a pattern here that's worth understanding. In tech, profits often come like a light switch – it seems like nothing's happening for years, then suddenly everything changes. Why? Because these businesses all share a few key traits:

They're expensive to build but cheap to run

They get better with scale (network effects)

Once customers sign up, they tend to stick around

The lesson for investors and entrepreneurs? Sometimes those losses aren't really losses – they're investments in future profits. The trick is figuring out which companies are building real operating leverage versus those that are just burning cash.

These five companies are showing us what the endgame looks like for successful tech businesses. They're proving that the old Silicon Valley motto of "growth at all costs" was maybe missing a few words. Perhaps it should have been "growth at all costs... until you hit scale, then profit like crazy."