The behavioral blindspot costing investors billions

Harvard Business School research shows that 70-90% of M&A transactions fail to create value for acquirers. McKinsey data reveals similar failure rates across private equity deals.

The failures aren't random. They follow predictable patterns.

After observing global markets for over a decade, I've seen the same behavioral blindspots repeatedly destroy value: founders whose true motivations were misread, cultural integration assumptions that proved catastrophically wrong, and customer relationships that evaporated under new ownership.

Yet most investment processes spend 80% of time on financial modeling and 20% on behavioral assessment. The data suggests this allocation is backwards.

What we learned from watching deals go wrong

Over the past decade, I've observed hundreds of transactions across global markets. The pattern repeats: sophisticated financial analysis coupled with elementary behavioral assessment.

Research from Harvard Business School shows that 70-90% of M&A transactions fail to create value. But here's what's interesting - the failures aren't random. They follow predictable behavioral patterns.

The three most common psychological blindspots:

- Founder psychology misreading: Assuming financial motivation when the founder actually values control and legacy

- Cultural integration assumptions: Believing "good people adapt" without assessing actual cultural compatibility

- Customer relationship overconfidence: Assuming relationships transfer automatically to new ownership

Yet most investment processes spend 80% of time on financial modeling and 20% on behavioral assessment. The data suggests this should be reversed.

Why cross-market opportunities create behavioral mispricing

Different markets operate with distinct psychological and cultural frameworks, creating systematic mispricing opportunities for investors who understand behavioral differences.

Three key market variations we exploit:

Time horizon mismatches: Some markets prioritize quarterly results while others optimize for decades, creating valuation gaps for patient capital investors who understand long-term value creation.

Relationship vs transaction focus: Markets vary dramatically in how they value customer relationships, employee loyalty, and stakeholder trust - traditional metrics often miss these differences.

Growth philosophy differences: Some cultures prioritize sustainable, steady growth while others focus on rapid scaling, creating opportunities where resilient business models get systematically undervalued.

These behavioral differences mean that applying standardized financial frameworks across diverse markets systematically misprices quality businesses.

The cross-market advantage adapted from Berkshire

Warren Buffett's approach works because it combines quality identification with behavioral understanding. We've adapted this framework for growth businesses across multiple markets.

Our systematic advantage:

- Quality identification: Sustainable competitive advantages, predictable cash flows, reinvestment opportunities

- Behavioral assessment: Founder psychology, organizational culture, market-specific relationship dynamics

- Cross-market perspective: Understanding how the same quality business gets valued differently in different markets

This creates opportunities while others compete on financial engineering or single-market expertise.

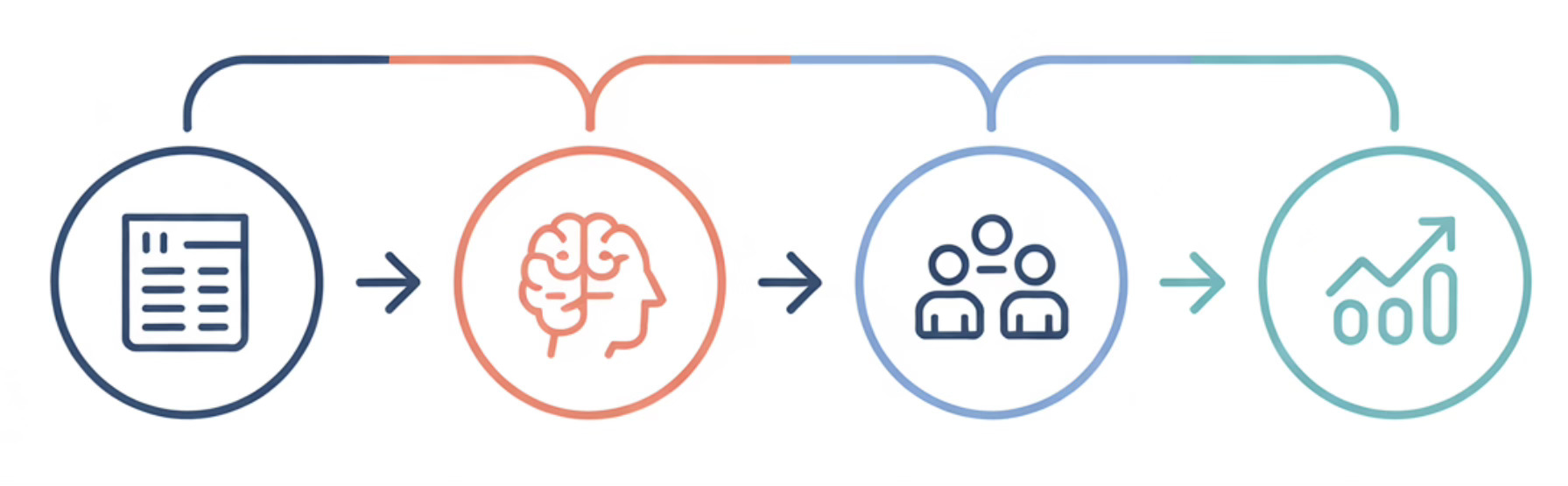

Our investment framework in practice

The QAPITAL methodology evaluates seven behavioral and financial dimensions:

Q - Quality of earnings: Revenue sustainability and margin predictability

A - Adaptability: Crisis response and business model flexibility

P - Predictability: Cash flow visibility and contract characteristics

I - Intrinsic advantages: Moat quality and pricing power

T - Team quality: Leadership capability and decision-making track record

A - Allocation excellence: Capital allocation efficiency and reinvestment returns

L - Long-term value: Growth potential and strategic vision

Each dimension receives a score from 1-10. We only invest in businesses scoring 8.0 or higher overall, with no single dimension below 7.0.

Building portfolio companies, not just holding investments

Our model goes beyond capital provision. We work with management teams to strengthen the behavioral and operational factors that drive long-term value creation.

Specific value-add capabilities:

- Strategic planning using behavioral insights

- Management team development and succession planning

- Customer relationship deepening and retention strategies

- Operational excellence through process optimization

- Digital transformation that enhances (rather than replaces) human relationships

This approach aligns with diverse business cultures while driving measurable performance improvements.

Why we're sharing our methodology

Traditional investment firms guard their processes. We're taking the opposite approach.

Three reasons for transparency:

- Better deal flow: When founders and advisors understand our approach, they bring us higher-quality opportunities

- Market education: Global markets benefit when buyers use more sophisticated assessment frameworks

- Compound learning: Sharing methodologies creates feedback loops that improve our own processes

This Substack will publish our actual frameworks, case studies (appropriately anonymized), and behavioral insights we use in real investments.

What we're building toward

Our goal is to create a platform that identifies and develops quality businesses across multiple sectors and markets.

Five-year vision:

- €100+ million assets under management

- 8-12 platform companies in our portfolio

- Recognized thought leadership in behavioral investing

- Proven track record of value creation through quality + behavioral insights

Current focus:

- Companies with €2-50 million annual revenue

- Global opportunities with emphasis on DACH, Benelux, Nordic, and selective US markets

- B2B services, software, manufacturing, and healthcare sectors

- Founder-led businesses with growth potential

Your role in this journey

If you're a founder building a quality business, an advisor working with growing companies, or an investor interested in behavioral approaches, this content is designed for you.

What you'll get from following our work:

- Practical frameworks for assessing business quality

- Behavioral insights that improve investment decisions

- Real case studies and lessons learned

- Transparent methodology that you can adapt and apply

Quality businesses deserve quality capital. Behavioral insights create sustainable competitive advantages.

That's what we're building at Qapital.

Want to connect? If you're working with quality businesses that might benefit from our approach, reach out directly. We're always interested in meeting founders and advisors who think long-term.