How to convert operational excellence into market-aligned value—without leaving millions on the table

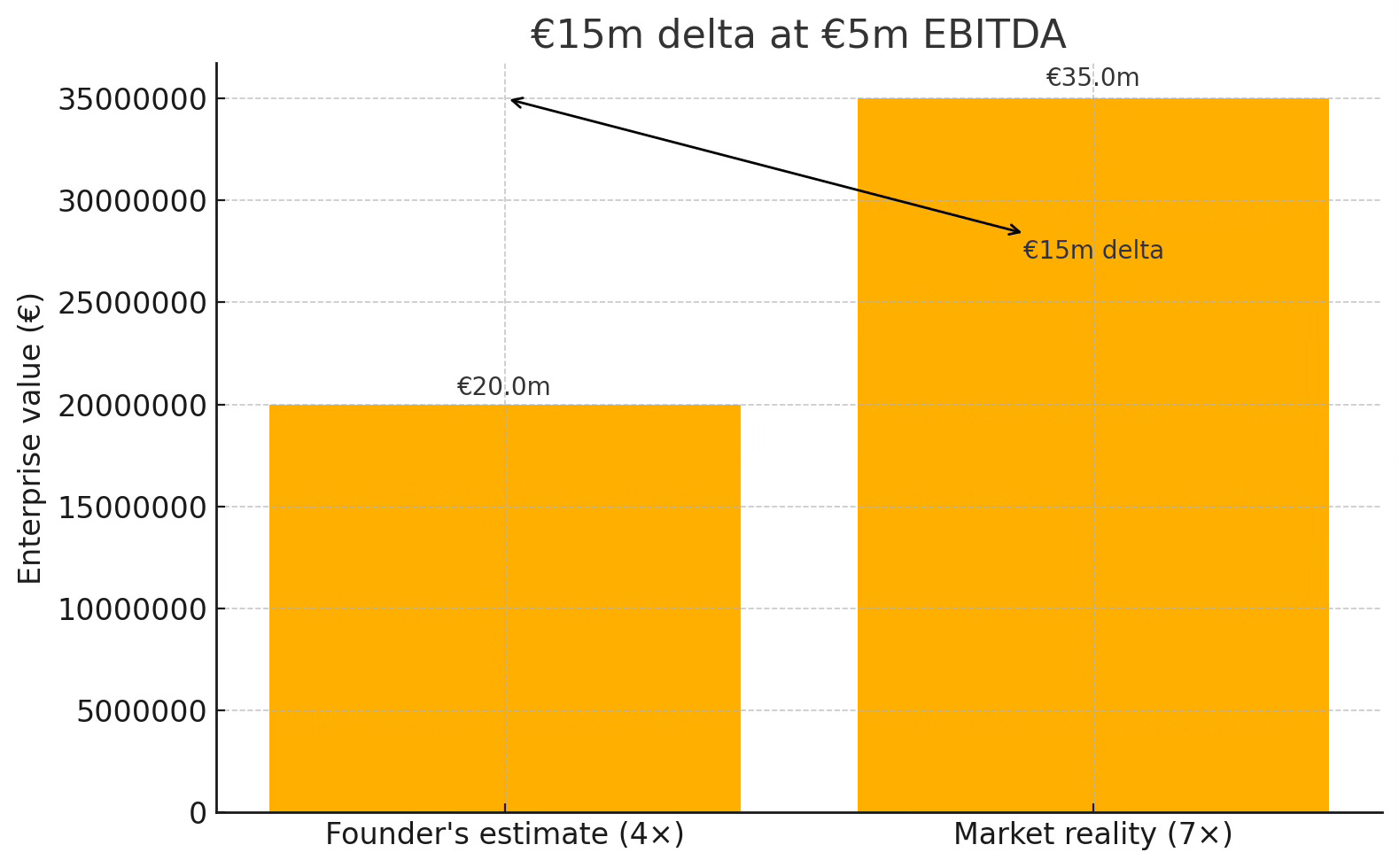

Many successful founders still think their company is worth "maybe 3-4 times earnings." Yet quality businesses in sectors like manufacturing, business services, and software often trade at higher multiples when they demonstrate predictable cash flows and competitive advantages. Example calculation: at €5M EBITDA, the difference between 4× (€20M) and 7× (€35M) is €15 million.

Smart investors understand this gap and systematically seek out these opportunities.

Opportunity gap

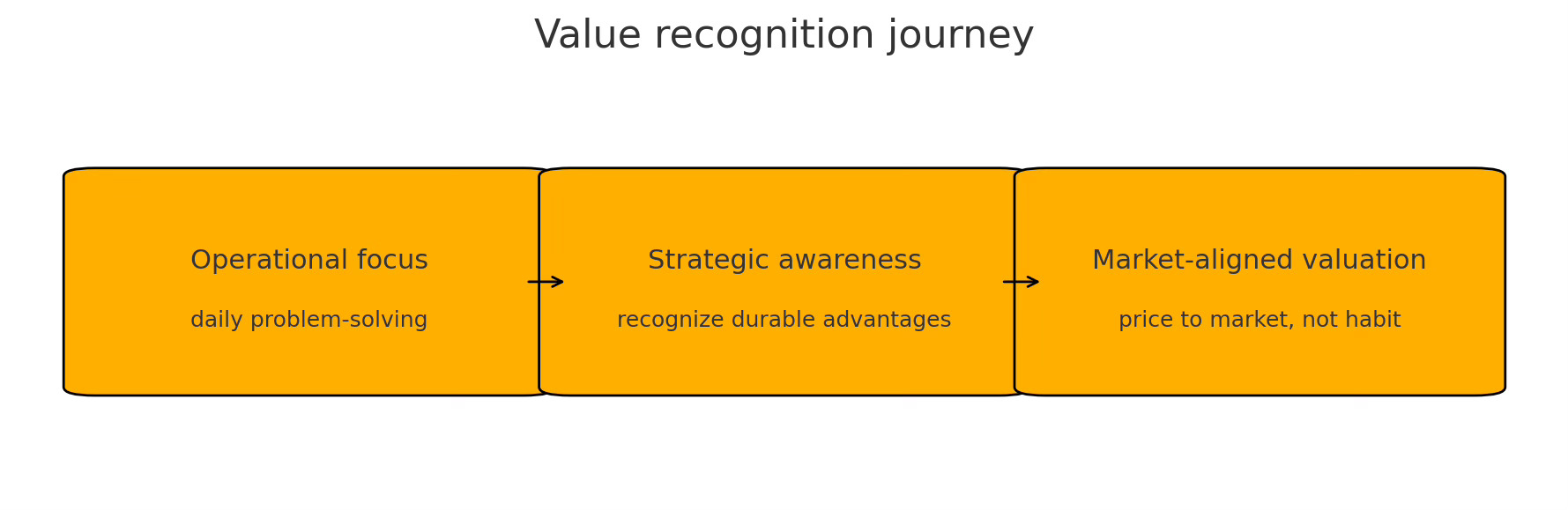

This valuation disconnect isn't rare—it's systematic. In my investment and business ownership experience, I've consistently observed entrepreneurs undervaluing their businesses relative to market conditions. They've spent decades focused on operations, seeing every internal challenge while often missing the competitive advantages they've methodically built.

This creates what I call the "behavioral discount", the gap between market-aligned value and founder self-assessment.

For founders, this can mean premature exits below market value. For investors, it means opportunities to acquire quality businesses at attractive prices…if you can distinguish between genuine weakness and unrecognized competitive strength.

Context

Through 25+ years of building and investing in businesses, I've observed what appears to be a consistent pattern: the same entrepreneurial traits that help build exceptional companies can sometimes create blind spots when founders assess their market value. My background in behavioral finance provides a framework for understanding why this might occur.

The founders who built the strongest businesses are frequently the most conservative when estimating what they've created.

Evidence & Insight

The psychology behind systematic undervaluation

Academic research in behavioral finance identifies cognitive patterns that consistently affect valuation assessments:

Availability heuristic and familiar risk overweighting Kahneman and Tversky's research on the availability heuristic shows that people overweight easily recalled information.¹ For founders, operational problems are vivid and frequent, while competitive advantages often develop gradually and become normalized. This creates systematic bias toward recognizing challenges over strengths.

Founders who've managed through crises have detailed mental maps of vulnerabilities but may underweight the resilience and competitive positioning these experiences actually demonstrated.

Anchoring bias on historical reference points Research by Strack and Mussweiler demonstrates how initial anchors powerfully influence subsequent valuations.² Founders often anchor on survival periods (early years, crisis management, break-even struggles) rather than current market position and cash generation capabilities.

A founder who remembers break-even struggles may anchor valuation discussions on those reference points rather than present-day metrics like customer retention, pricing power, or competitive positioning.

Loss aversion in investment psychology Prospect theory research shows people feel losses more acutely than equivalent gains.³ Founders have already "invested" years of sacrifice, forgone opportunities, and personal resources. This investment often becomes the psychological anchor for value assessment rather than forward-looking market dynamics.

What market-based valuation actually considers

Professional investors and strategic acquirers evaluate businesses using criteria that founders may not fully appreciate:

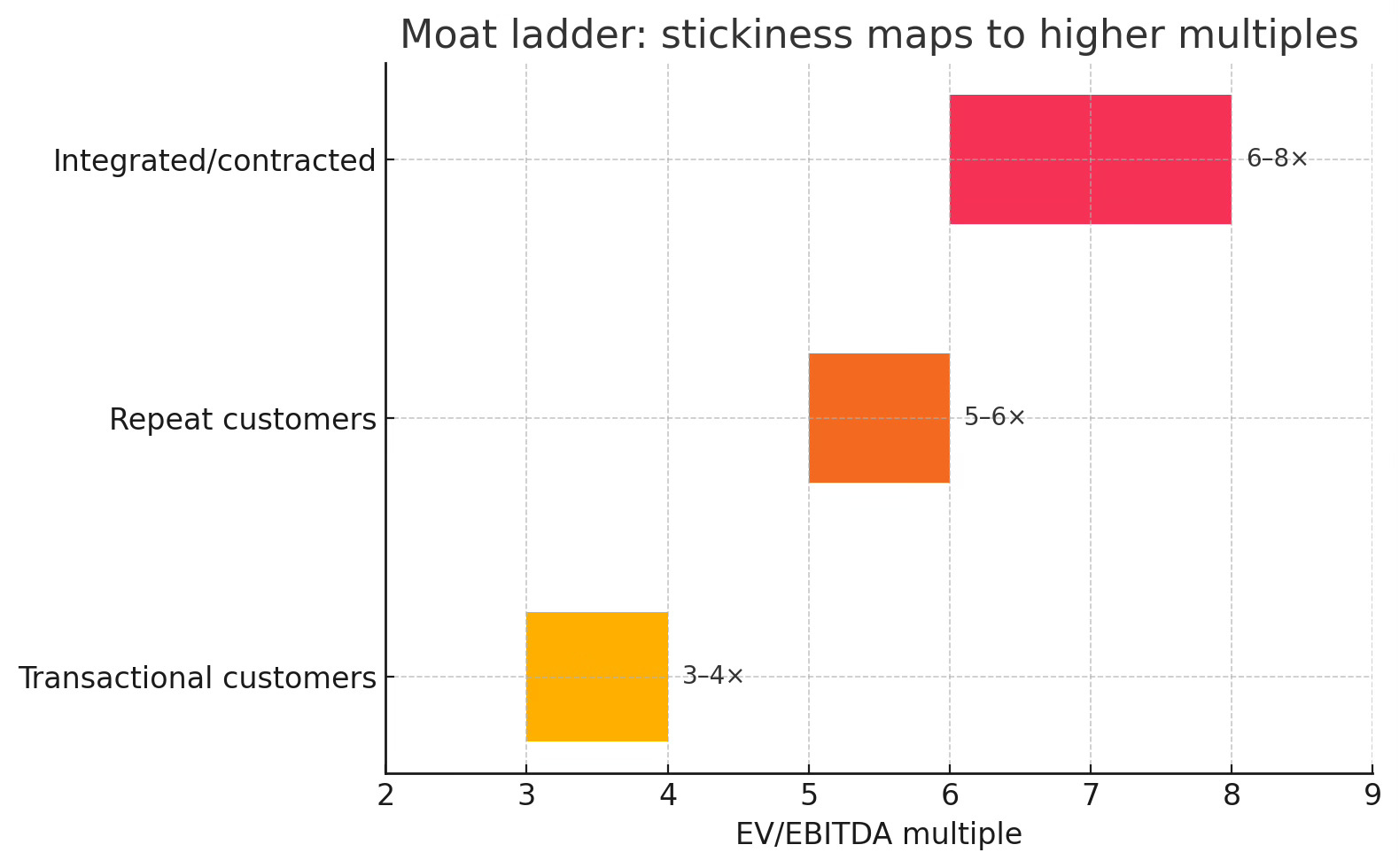

Cash flow predictability and customer economics Research by Damodaran on valuation multiples shows that businesses with recurring revenue, long customer lifecycles, and low churn rates command premium valuations across sectors.⁴ Yet founders often view stable customer relationships as "normal business operations" rather than recognizing them as valuable differentiators.

Competitive positioning and pricing power Warren Buffett's concept of "economic moats" reflects market recognition that sustainable competitive advantages justify higher valuations.⁵ Businesses that can raise prices without losing customers, maintain market share during competitive pressure, or possess regulatory/geographic advantages often trade at premium multiples.

Operational leverage and scalability McKinsey research on business model analysis demonstrates that companies with high incremental margins, asset-light operations, or network effects receive valuation premiums.⁶ Founders focused on daily operations may not recognize how their business model characteristics compare to market preferences.

Actionable framework: Systematic Value Assessment

A evidence-based approach to identify potentially undervalued business characteristics:

Step 1: Customer economics analysis Calculate verifiable metrics that professional investors examine:

- Customer lifetime value relative to acquisition cost

- Annual churn/retention rates by customer cohort

- Revenue per customer trends over time

- Contract duration and renewal patterns

Academic basis: Research by Reinartz and Kumar on customer lifetime value demonstrates its correlation with business valuations.⁷

Step 2: Competitive position assessment Document observable competitive dynamics:

- Price leadership: Do competitors follow your pricing moves?

- Market share trends: Gaining, maintaining, or losing position?

- Customer switching patterns: How often do lost customers return to competitors?

- Competitive response time: How quickly do rivals react to your strategic moves?

Research foundation: Porter's Five Forces framework provides systematic methodology for competitive analysis.⁸

Step 3: Business model evaluation

Assess structural characteristics that affect valuations:

- Fixed vs. variable cost structure

- Barriers to entry in your specific market

- Customer switching costs (time, training, integration requirements)

- Geographic or regulatory advantages

Supporting research: Christensen's business model analysis framework demonstrates correlation between model characteristics and financial performance.⁹

How professional buyers evaluate businesses

Strategic acquirers and private equity firms apply systematic methodologies:

- Normalize EBITDA for owner compensation and one-time items

- Separate maintenance capex from growth investment

- Analyze customer concentration and retention by cohort

- Assess competitive positioning through customer interviews and market analysis

- Model various scenarios for revenue predictability and growth potential

Understanding these evaluation criteria helps founders recognize which business characteristics drive valuation premiums.

Self-assessment questions

Based on professional valuation methodologies, consider these indicators:

Customer relationship strength:

- Do customers renew contracts despite price increases?

- How long would it take a customer to switch to a competitor?

- What percentage of revenue comes from customers you've retained 3+ years?

Market positioning:

- Do competitors follow your pricing or strategic moves?

- How often do you lose business purely on price vs. other factors?

- What would happen to your margins if you raised prices 5%?

Business model resilience:

- How did your business perform during the last economic downturn?

- What percentage of your costs are variable vs. fixed?

- How dependent is your business on your personal involvement?

Broader Implications

Understanding market-based valuation methods has strategic implications beyond exit planning. Founders who recognize their competitive positioning make different decisions about:

- Growth investment priorities

- Customer retention vs. acquisition focus

- Pricing strategy and market positioning

- Strategic partnership opportunities

For investors, systematic founder undervaluation creates opportunities to acquire quality businesses below their strategic value—provided thorough due diligence validates both financial performance and competitive positioning.

Call to conversation

What methodology do you currently use to assess your business value? How do you factor in competitive advantages that developed gradually over time?

We've developed a systematic Business Value Assessment Framework based on professional valuation methodologies. It evaluates customer economics, competitive positioning, and business model characteristics using the same criteria that strategic acquirers and investors apply.

The framework helps identify which business characteristics might be undervalued relative to market standards, useful whether you're assessing your own company or evaluating potential investments.

Understanding market-based valuation isn't about ego, it's about making informed strategic decisions based on how professional investors actually evaluate businesses.

References:

- Kahneman, D., & Tversky, A. (1974). "Judgment under uncertainty: Heuristics and biases." Science, 185(4157), 1124-1131.

- Strack, F., & Mussweiler, T. (1997). "Explaining the enigmatic anchoring effect: Mechanisms of selective accessibility." Journal of Personality and Social Psychology, 73(3), 437-446.

- Kahneman, D., & Tversky, A. (1979). "Prospect theory: An analysis of decision under risk." Econometrica, 47(2), 263-291.

- Damodaran, A. (2012). "Investment Valuation: Tools and Techniques for Determining the Value of Any Asset." 3rd Edition.

- Buffett, W. (1995). Berkshire Hathaway Annual Letter to Shareholders.

- McKinsey & Company. (2020). "Strategy & Corporate Finance Practice: Valuation Methods."

- Reinartz, W., & Kumar, V. (2002). "The mismanagement of customer loyalty." Harvard Business Review, 80(7), 86-94.

- Porter, M. E. (1979). "How competitive forces shape strategy." Harvard Business Review, 57(2), 137-145.

- Christensen, C. M., & Raynor, M. E. (2003). "The Innovator's Solution." Harvard Business Review Press.

*All financial examples are illustrative calculations based on hypothetical scenarios for educational purposes.