What we do differently

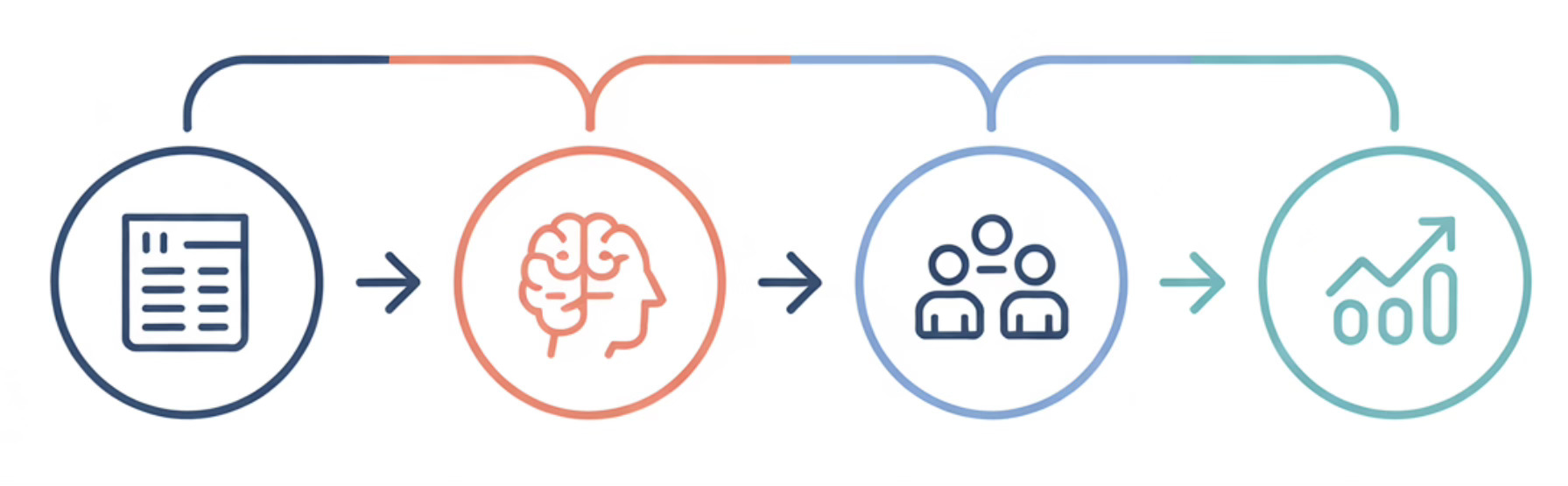

Most investors analyze spreadsheets. We analyze psychology.

Harvard research shows 70-90% of business acquisitions fail to create value. The problem isn't financial modeling - it's behavioral blindspots. Founders' true motivations get misread. Company cultures clash during integration. Customer relationships dissolve under new ownership.

At Qapital, we use behavioral insights to identify quality businesses trading below their growth potential. We're building a concentrated portfolio of quality companies that can compound returns for decades.

Think Berkshire Hathaway meets behavioral economics, focused on quality growth businesses.

Our investment framework

We evaluate every business using the QAPITAL methodology - seven dimensions that predict long-term value creation:

Q - Quality of Business Economics

Revenue sustainability, margin defensibility, capital efficiency

A - Allocation & Returns

ROIC trends, reinvestment effectiveness, capital deployment discipline

P - Predictability & Visibility

Cash flow visibility, customer retention, business model resilience

I - Intrinsic Advantages

Competitive moats, pricing power, barrier sustainability

T - Team & Organization

Leadership capability, decision-making effectiveness, organizational depth

A - Alignment & Incentives

Compensation structures, insider ownership, stakeholder balance

L - Long-term Orientation

Strategic patience, reinvestment focus, sustainable value creation

What makes this different: We don’t use fixed weightings. Instead, each analysis identifies which 2-3 elements matter most for that specific company and why, supported by academic research on competitive advantage and quality factor importance.

The behavioral lens reveals quality advantages before they appear in financial statements and quality deterioration before it shows in the numbers.

What you'll learn here

Every Tuesday: Behavioral insights and 60-second assessment tools

Every Other Friday: Deep company analysis with complete QAPITAL framework application

What you’ll see:

- 60-second behavioral assessment tools you can use immediately

- Complete company analyses with QAPITAL scores and valuation work

- Real investment decisions explained with transparent methodology

Why we share our methodology

Traditional investment firms hide their processes. We do the opposite.

Transparency creates three advantages:

- Better deal flow: When founders understand our approach, they bring higher-quality opportunities

- Market education: Quality businesses deserve sophisticated assessment frameworks

- Compound learning: Sharing methodologies creates feedback that improves our processes

Every framework we publish gets tested with real capital.

Who this is for

You'll find value here if you're:

- An investor wanting to identify quality businesses through behavioral pattern recognition

- A founder building a quality business (understand what sophisticated investors look for)

- An advisor working with growing companies (better frameworks for client evaluation)

- Anyone who thinks most business analysis misses the human element

If you believe cognitive patterns create competitive advantages (and destroy them), you’re in the right place.

Your first articles to read

New to behavioral investing? Start with our Tuesday insights to see how cognitive biases cost investors money and how to counter them.

Ready for deep analysis? Our Friday analyses show exactly how we evaluate specific companies using the QAPITAL framework.

Want the complete methodology? Keep reading, we’ll explain exactly what you get at each level.

Get the frameworks

Free subscription:

- Every Tuesday: Behavioral insights and 60-second assessment tools

- Every other Friday: Complete company analyses with QAPITAL framework

- At least 6 pieces per month

Premium subscription (€29/month or €290/year):

- Everything in free, plus:

- Quarterly investment cases (30-40 pages) - Institutional-quality deep-dives with complete financial modeling, valuation analysis, and multi-year monitoring frameworks

- Quarterly Q&A to discuss cases and get feedback on your investments

- Growing archive of all past quarterlies and Q&As

Want to learn the methodology yourself?

Advanced tools and frameworks available at BuyBuildScale.co:

- Behavioral Finance Toolkit (€47): 12 bias checklists, decision frameworks, pre-investment tools

- Quality Assessment Framework (€297): Complete QAPITAL methodology with templates, case studies, video walkthroughs

- Custom Company Analysis (€3,000-7,000): Full QAPITAL assessment of your specific target with detailed report and discussion

Bottom line: Quality businesses deserve quality analysis. Behavioral insights reveal competitive advantages traditional analysis systematically misses.

Most investment analysis focuses on outcomes; revenue, margins, ROIC. We analyze the decision patterns and organizational behaviors that create those outcomes.

This reveals quality before it shows up in the numbers.

If you think most investment analysis misses the human element, you’re in the right place.

Subscribe now and start seeing what markets systematically miss.

Questions? Reply to any email or connect with us directly. We're always interested in meeting founders and investors who think long-term.