Insights

Why some revenue is worth 2x and other revenue 8x

Two businesses, same revenue, one sells for 4x more. The difference is revenue quality. Here's how to assess it before buyers or sellers figure it out.

· Ruben van Putten

VC funding and gender: What the data reveals about European tech in 2025

Female and mixed-gender founding teams receive 6-28% of European VC funding despite equal performance. The gap is widening, not narrowing. Data from 2025.

· Ruben van Putten

Three questions that reveal if your moat actually exists

Three practical tests to validate if your competitive advantage is real. Score pricing power, replication risk, and founder dependency before diligence does.

· Ruben van Putten

Seven behavioral traps that inflate valuations

Seven behavioral traps quietly inflate M&A valuations. Use a four-step protocol to counter bias, haircut synergies, and keep discipline at the bid table.

· Ruben van Putten

When founders become bottlenecks

Founder dependency kills scalability. Spot it in diligence and replace with systems that protect revenue and decisions in 90 days.

· Ruben van Putten

Why some €2M companies outperform €20M ones

Research shows small focused companies often outperform larger diversified ones. Why complexity costs exceed scale benefits, backed by strategy research.

· Ruben van Putten

The silent killer of small business acquisitions

Why most business acquisitions fail: information asymmetry isn't just seller deception. Learn how to build verification systems that protect against biases.

· Ruben van Putten

How investor noise kills good deals

The same pitch deck, two different scores: what changed? Nothing about the company. Everything about you.

· Ruben van Putten

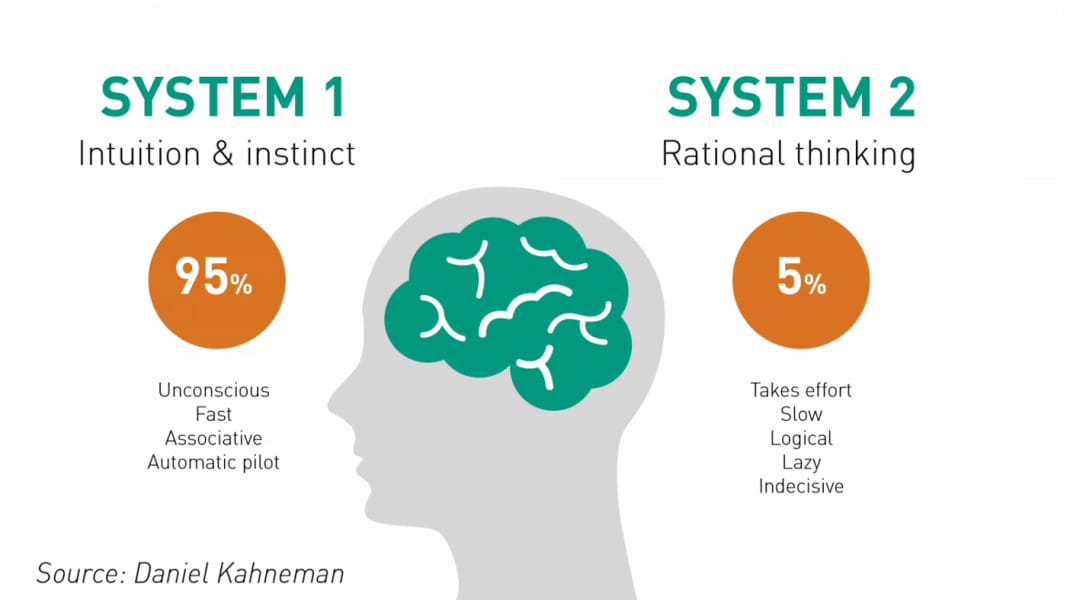

VC pattern recognition or pattern projection? The science behind investment judgment

When examining a new deal, venture capitalists rely heavily on pattern recognition. This ability is widely considered essential to investment success. But cognitive science research reveals a critical distinction we often miss.

· Ruben van Putten

Why your €5M business needs Good to Great principles more than Google does

Jim Collins studied Fortune 500 giants. But his Good to Great patterns work better in small businesses because you can actually implement them. Here's why.

· Ruben van Putten

This one sentence in earnings calls reveals everything about management quality

Learn the CEO language pattern that predicts company problems 2-3 quarters early. Analysis of earnings calls reveals what separates great management from trouble ahead.

· Ruben van Putten

5 Quality Stocks Trading Below 15x PE

Five household names generating 25%+ ROE trading at single-digit to mid-teen P/E ratios. This week's quality screen reveals Merck, UPS, Target, Delta, and Comcast offering 7.2% equity risk premiums.

· Ruben van Putten

How sellers exploit your confirmation bias

Smart sellers structure data rooms to exploit confirmation bias. Learn how sequential information presentation manipulates M&A decisions and three tactics to counter it.

· Ruben van Putten

What Klarna teaches us about crisis discipline.

Klarna went from $46B to $6.7B and back to $15.9B. The behavioral patterns during crisis reveal more about business quality than any IPO valuation ever could.

· Ruben van Putten

The priming trap: Why the first number you see costs you money

Why the first number you see in negotiations destroys valuation discipline. Research-backed insights on anchoring bias and three practical tactics to counter it.

· Ruben van Putten

When "improving" an acquisition destroys it: The Quaker Snapple disaster

Quaker paid $1.7B for Snapple in 1994, sold for $300M in 1997. How confirmation bias and forced integration destroyed $1.4B in value in three years.

· Ruben van Putten

Why Netflix beats competitors who overthink

Learn how Netflix's decision speed creates competitive advantage. Discover the 60-second assessment tool to identify fast-moving quality businesses.

· Ruben van Putten

What separates quality businesses from the rest

Research reveals why traditional business metrics miss the mark. Discover the behavioral patterns that separate exceptional businesses from the rest, plus a 60-second framework to assess quality in any company.

· Ruben van Putten

Quality investing with behavioral insights

Learn how we use behavioral insights to identify quality businesses trading below their potential. Get practical frameworks for cross-market investing and business analysis.

· Ruben van Putten

The behavioral patterns that predict which businesses will compound for decades

Warren Buffett looks for businesses 'an idiot could run' - but what really predicts decades of compound growth? New research reveals 3 behavioral patterns that separate value builders from value extractors.

· Ruben van Putten

Why we started Qapital: quality growth investing with a behavioral edge

Discover why 70-90% of business acquisitions fail and how Qapital uses behavioral insights to identify quality growth companies others miss. Our approach combines financial analysis with founder psychology assessment.

· Ruben van Putten

Why founders sell for half what their business is worth

The psychological patterns that make founders sell quality businesses below market value. A behavioral framework for growth investors.

· Ruben van Putten

Why smart buyers overpay

Discover why smart buyers overpay in M&A deals — and how negotiation psychology reveals better strategies to secure lasting value.

· Ruben van Putten

Why smart VCs make predictably bad decisions

Why do experienced venture capitalists consistently underperform systematic decision models? Behavioral research reveals how dual-process thinking, information sequencing, and cognitive biases lead smart investors to make predictably poor decisions in venture evaluation.

· Ruben van Putten

The AI quality divide: Why most AI startups will fail the behavioral test

Bessemer's 2025 AI report reveals a startling divide: explosive-growth AI startups hit $125M revenue but operate at just 25% margins, while quality-focused companies build sustainable 60% margin businesses. Here is our view.

· Ruben van Putten

The founder premium: why owner-operated businesses consistently outperform

Discover why founder-led businesses deliver 23% higher growth and superior returns. Learn the behavioral psychology behind the founder premium and how quality growth investors can identify these exceptional opportunities.

· Ruben van Putten

The founder's valuation trap

Why successful entrepreneurs consistently undervalue their businesses by 30-50% and how investors capitalize on this behavioral pattern.

· Ruben van Putten

Three cognitive biases that destroy M&A value

Three cognitive biases destroy 70-90% of M&A deals, costing companies billions. Research shows overconfidence, anchoring, and confirmation bias systematically distort valuations and integration planning. Learn how behavioral finance insights can improve deal outcomes.

· Ruben van Putten

The $1M glass ceiling: 3 psychological levers that break it

Only 5% of all businesses in the US grow to be more than $1 million in annual revenues, according to 2020 research.

· Ruben van Putten

Why Sun Tzu's art of war built Amazon

The 2,500 year old military strategy that created the world's most ruthless business empire

· Ruben van Putten