Ruben van Putten

44 posts published

5 Quality Stocks Trading Below 15x PE

Five household names generating 25%+ ROE trading at single-digit to mid-teen P/E ratios. This week's quality screen reveals Merck, UPS, Target, Delta, and Comcast offering 7.2% equity risk premiums.

· Ruben van Putten

How sellers exploit your confirmation bias

Smart sellers structure data rooms to exploit confirmation bias. Learn how sequential information presentation manipulates M&A decisions and three tactics to counter it.

· Ruben van Putten

What Klarna teaches us about crisis discipline.

Klarna went from $46B to $6.7B and back to $15.9B. The behavioral patterns during crisis reveal more about business quality than any IPO valuation ever could.

· Ruben van Putten

The priming trap: Why the first number you see costs you money

Why the first number you see in negotiations destroys valuation discipline. Research-backed insights on anchoring bias and three practical tactics to counter it.

· Ruben van Putten

When "improving" an acquisition destroys it: The Quaker Snapple disaster

Quaker paid $1.7B for Snapple in 1994, sold for $300M in 1997. How confirmation bias and forced integration destroyed $1.4B in value in three years.

· Ruben van Putten

Why Netflix beats competitors who overthink

Learn how Netflix's decision speed creates competitive advantage. Discover the 60-second assessment tool to identify fast-moving quality businesses.

· Ruben van Putten

What separates quality businesses from the rest

Research reveals why traditional business metrics miss the mark. Discover the behavioral patterns that separate exceptional businesses from the rest, plus a 60-second framework to assess quality in any company.

· Ruben van Putten

Quality investing with behavioral insights

Learn how we use behavioral insights to identify quality businesses trading below their potential. Get practical frameworks for cross-market investing and business analysis.

· Ruben van Putten

The behavioral patterns that predict which businesses will compound for decades

Warren Buffett looks for businesses 'an idiot could run' - but what really predicts decades of compound growth? New research reveals 3 behavioral patterns that separate value builders from value extractors.

· Ruben van Putten

Why we started Qapital: quality growth investing with a behavioral edge

Discover why 70-90% of business acquisitions fail and how Qapital uses behavioral insights to identify quality growth companies others miss. Our approach combines financial analysis with founder psychology assessment.

· Ruben van Putten

Why founders sell for half what their business is worth

The psychological patterns that make founders sell quality businesses below market value. A behavioral framework for growth investors.

· Ruben van Putten

Why smart buyers overpay

Discover why smart buyers overpay in M&A deals — and how negotiation psychology reveals better strategies to secure lasting value.

· Ruben van Putten

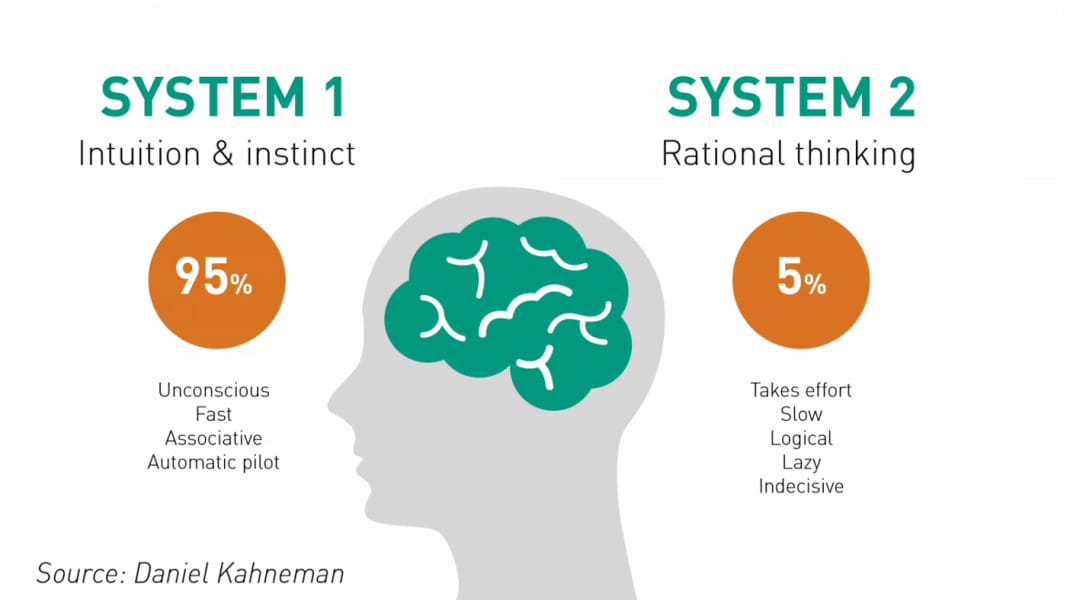

Why smart VCs make predictably bad decisions

Why do experienced venture capitalists consistently underperform systematic decision models? Behavioral research reveals how dual-process thinking, information sequencing, and cognitive biases lead smart investors to make predictably poor decisions in venture evaluation.

· Ruben van Putten

The AI quality divide: Why most AI startups will fail the behavioral test

Bessemer's 2025 AI report reveals a startling divide: explosive-growth AI startups hit $125M revenue but operate at just 25% margins, while quality-focused companies build sustainable 60% margin businesses. Here is our view.

· Ruben van Putten

The founder premium: why owner-operated businesses consistently outperform

Discover why founder-led businesses deliver 23% higher growth and superior returns. Learn the behavioral psychology behind the founder premium and how quality growth investors can identify these exceptional opportunities.

· Ruben van Putten

The founder's valuation trap

Why successful entrepreneurs consistently undervalue their businesses by 30-50% and how investors capitalize on this behavioral pattern.

· Ruben van Putten

Three cognitive biases that destroy M&A value

Three cognitive biases destroy 70-90% of M&A deals, costing companies billions. Research shows overconfidence, anchoring, and confirmation bias systematically distort valuations and integration planning. Learn how behavioral finance insights can improve deal outcomes.

· Ruben van Putten

The $1M glass ceiling: 3 psychological levers that break it

Only 5% of all businesses in the US grow to be more than $1 million in annual revenues, according to 2020 research.

· Ruben van Putten

Why Sun Tzu's art of war built Amazon

The 2,500 year old military strategy that created the world's most ruthless business empire

· Ruben van Putten

The dealmaker's playbook: 10 principles that turn good businesses into great acquisitions

Most acquisition advice focuses on financial engineering or negotiation tactics. But the real edge comes from understanding human psychology and business fundamentals.

· Ruben van Putten

MercadoLibre behavioral equity analysis: When regional bias creates opportunity

A comprehensive assessment combining fundamental strength with behavioral opportunity recognition. Quality business at crisis valuations for patient capital.

· Ruben van Putten

Behavioral analysis: What Novo Nordisk's 60% decline reveals about market psychology

Novo Nordisk down 60% despite strong fundamentals. Our behavioral analysis reveals why market psychology creates acquisition opportunities for investors.

· Ruben van Putten

The behavioral due diligence framework for service M&A

Going beyond financials to assess the human elements that determine acquisition success

· Ruben van Putten

Warren Buffett's $100 billion brain hack: The psychology behind his returns

Today, we're decoding the four mental frameworks that separated Buffett from everyone else. This isn't motivation. It's applied neuroscience that transformed a normal brain into a wealth-building machine.

· Ruben van Putten

How founder psychology affects service company valuations

The emotional dynamics that create negotiating opportunities in professional services deals

· Ruben van Putten

The $850 million mistake: How anchoring bias destroyed a hedge fund

This isn't just another trading disaster story. This is about anchoring bias—a psychological trap so subtle that even Nobel Prize winners fall victim. And it's probably costing you money right now.

· Ruben van Putten

Why we target service companies

The behavioral and financial advantages that make service businesses ideal acquisition targets

· Ruben van Putten

The split-second bias: why information order determines who gets funded

New research reveals how information sequence in VC pitches creates gender bias. Female entrepreneurs receive only 3% of funding—here's how changing presentation order could transform investment decisions and unlock billions in missed opportunities.

· Ruben van Putten

How to build a small-cap discovery machine

Here's the exact process I've refined over 200+ small-cap analyses, including how to spot behavioral tells that institutions miss.

· Ruben van Putten

Why we focus on service companies

73% of acquisitions fail to create value. Not because of financial metrics or market conditions, but because of psychology. Human biases, emotional attachment, and flawed decision-making destroy deals before they even close.

· Ruben van Putten