Why some revenue is worth 2x and other revenue 8x

Two businesses, same revenue, one sells for 4x more. The difference is revenue quality. Here's how to assess it before buyers or sellers figure it out.

· Ruben van Putten

VC funding and gender: What the data reveals about European tech in 2025

Female and mixed-gender founding teams receive 6-28% of European VC funding despite equal performance. The gap is widening, not narrowing. Data from 2025.

· Ruben van Putten

Three questions that reveal if your moat actually exists

Three practical tests to validate if your competitive advantage is real. Score pricing power, replication risk, and founder dependency before diligence does.

· Ruben van Putten

Seven behavioral traps that inflate valuations

Seven behavioral traps quietly inflate M&A valuations. Use a four-step protocol to counter bias, haircut synergies, and keep discipline at the bid table.

· Ruben van Putten

When founders become bottlenecks

Founder dependency kills scalability. Spot it in diligence and replace with systems that protect revenue and decisions in 90 days.

· Ruben van Putten

Why some €2M companies outperform €20M ones

Research shows small focused companies often outperform larger diversified ones. Why complexity costs exceed scale benefits, backed by strategy research.

· Ruben van Putten

Masterclass

· Ruben van Putten

Toolkit

· Ruben van Putten

The silent killer of small business acquisitions

Why most business acquisitions fail: information asymmetry isn't just seller deception. Learn how to build verification systems that protect against biases.

· Ruben van Putten

How investor noise kills good deals

The same pitch deck, two different scores: what changed? Nothing about the company. Everything about you.

· Ruben van Putten

VC pattern recognition or pattern projection? The science behind investment judgment

When examining a new deal, venture capitalists rely heavily on pattern recognition. This ability is widely considered essential to investment success. But cognitive science research reveals a critical distinction we often miss.

· Ruben van Putten

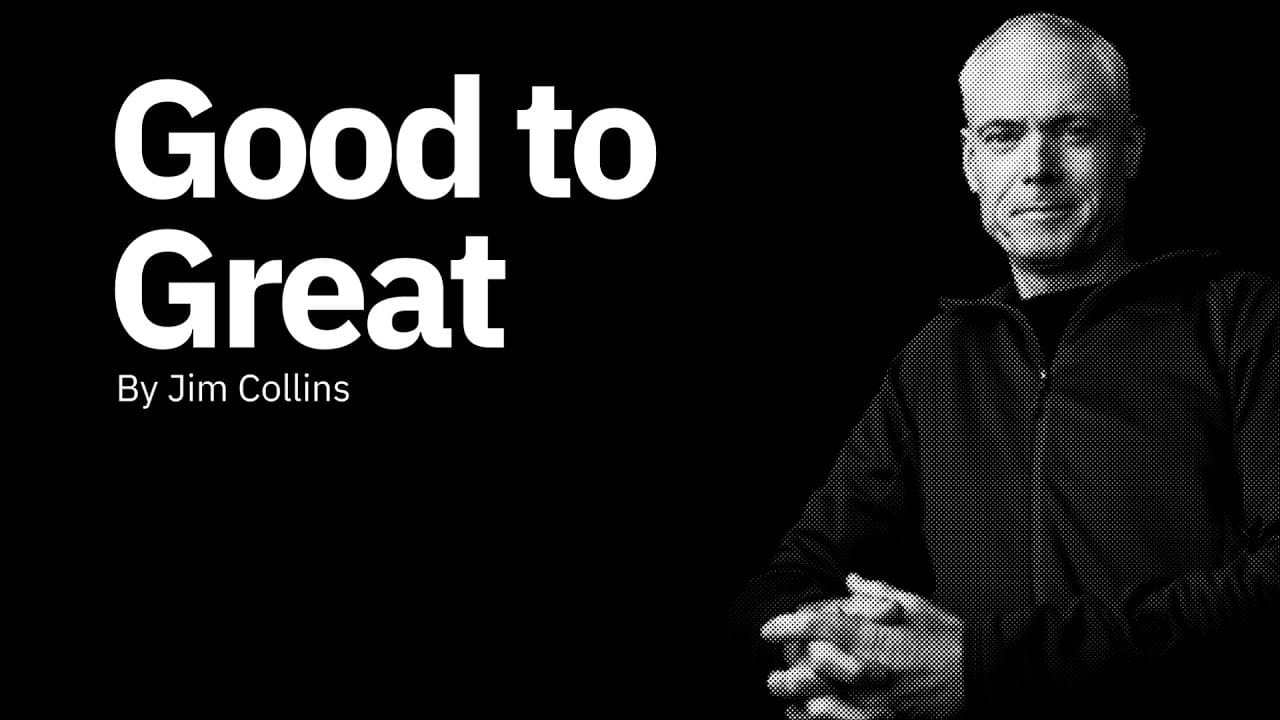

Why your €5M business needs Good to Great principles more than Google does

Jim Collins studied Fortune 500 giants. But his Good to Great patterns work better in small businesses because you can actually implement them. Here's why.

· Ruben van Putten

This one sentence in earnings calls reveals everything about management quality

Learn the CEO language pattern that predicts company problems 2-3 quarters early. Analysis of earnings calls reveals what separates great management from trouble ahead.

· Ruben van Putten

CEO Language Red Flags Checklist

· Ruben van Putten